- 0

- Login

- David Love

- B.A.B.Y. Ministry

- Marriage

- RIA Conference 2023 Round 1

- Lashawnda Shiree Inc.

- Intellectual Designs

- …

- David Love

- B.A.B.Y. Ministry

- Marriage

- RIA Conference 2023 Round 1

- Lashawnda Shiree Inc.

- Intellectual Designs

- David Love

- B.A.B.Y. Ministry

- Marriage

- RIA Conference 2023 Round 1

- Lashawnda Shiree Inc.

- Intellectual Designs

- …

- David Love

- B.A.B.Y. Ministry

- Marriage

- RIA Conference 2023 Round 1

- Lashawnda Shiree Inc.

- Intellectual Designs

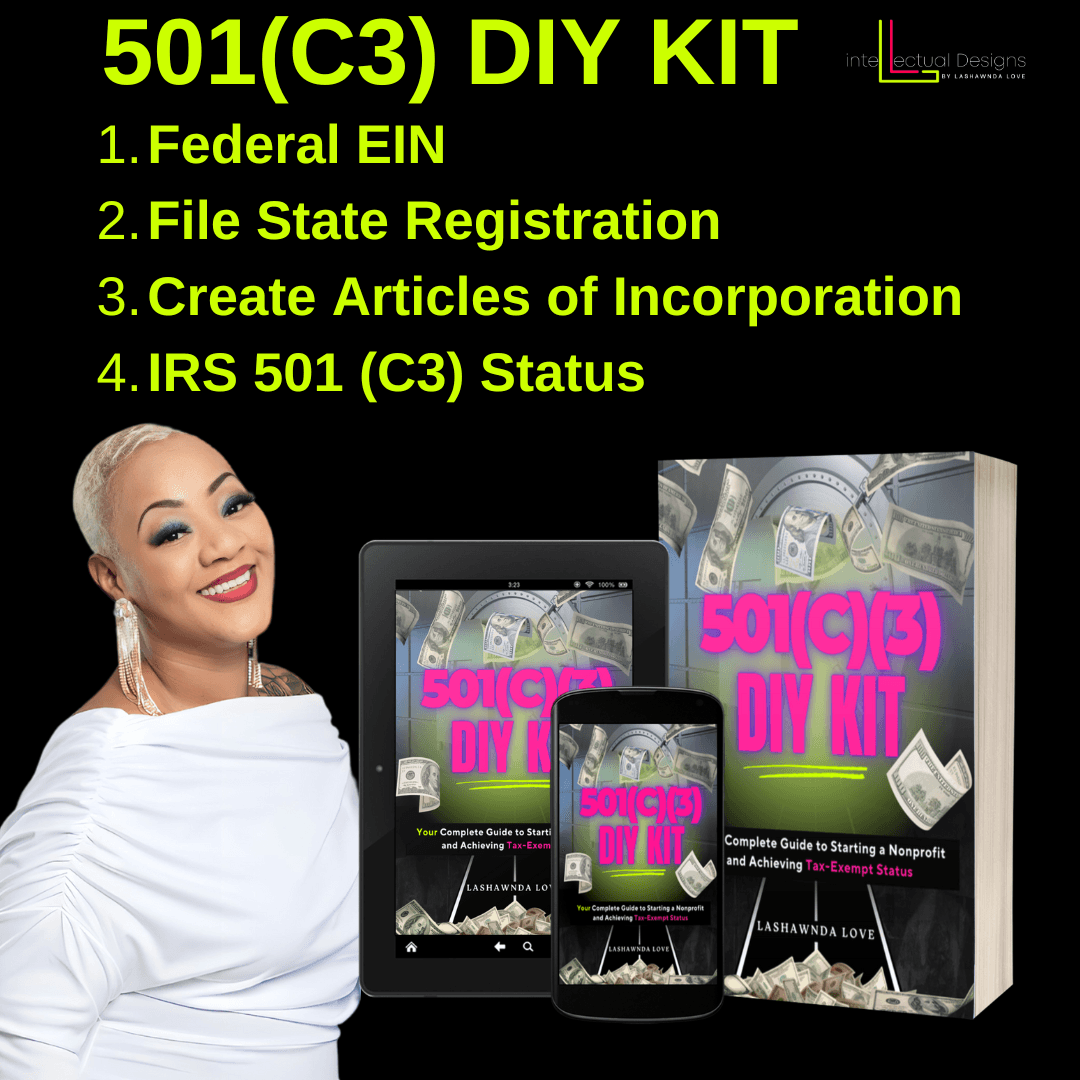

501C3

Introducing Our Newest Resources!

Transform your nonprofit dreams into reality with our expertly designed 501(c)(3) DIY Kits! Tailored for organizations making under $50,000 annually, these kits simplify the process of applying for tax-exempt status. Whether you're just starting or need a streamlined approach, we’ve got you covered!

Introducing Our 501(c)(3) Service Bundles for Nonprofit Organizations!

At Intellectual Designs, we simplify the journey to obtaining and maintaining your nonprofit’s tax-exempt status. Whether you're just starting out or need help finalizing key steps, our comprehensive service bundles provide the tools and guidance to help your nonprofit succeed.

501(c)(3) DIY Kit Bundle 1 - $399.99

A streamlined solution to starting your nonprofit journey.

What’s Inside:

✔️ Clear, Step-by-Step Instructions: Filing Form 1023-EZ has never been easier.

✔️ Pre-Filled Example Form: Reduce errors with detailed visual references.

✔️ Links & Checklists: Access the IRS tools you need to succeed.

✔️ Status Maintenance Tips: Learn to keep your nonprofit compliant and operational.

✔️ Bonus Content: Additional insights for sustained success.📌 Perfect for: Beginners who want to navigate the IRS process with ease.

If the DIY Kit isn’t the right fit for you, let Intellectual Designs by Lashawnda Love handle the process for you!

501(C3)Bundle 1- $1299.99

We specialize in guiding you through every step to secure your IRS 501(c)(3) tax-exempt status—stress-free and professionally done.

What’s Included:

✅ IRS 501(c)(3) Status: Comprehensive guidance through the entire process of obtaining your tax-exempt status from the IRS.- 📌 Perfect for: Nonprofits needing hands-on support to successfully achieve 501(c)(3) status!

501(c)(3) DIY Kit Bundle 2 - $599.99

Everything you need to launch your nonprofit with confidence!

Everything you need to launch your nonprofit with confidence!

What’s Included:

✅ Step-by-Step Instructions: Easy guidance to complete all the essential steps for nonprofit establishment.

✅ Federal EIN: Instructions to secure your Employer Identification Number.

✅ State Registration: Guidance to file your state registration.

✅ Create Articles of Incorporation: Simplify this foundational step with our tools.

✅ IRS 501(c)(3) Status: Comprehensive support for completing and submitting Form 1023-EZ.

✅ Pre-Filled Example Form: Visual examples to eliminate guesswork.

✅ Essential Tools & Checklists: Stay organized and efficient throughout the process.

✅ Compliance Tips: Practical advice to maintain your nonprofit’s 501(c)(3) status.

✅ Bonus Resources: Exclusive tools to help your nonprofit thrive beyond the application.📌 Perfect for: Nonprofits ready to hit the ground running with extra support for long-term success!

If the DIY Kit isn’t the right fit for you, let Intellectual Designs by Lashawnda Love handle the process for you!

501(C3) Bundle 2-$2,299.99

Ideal for organizations starting from scratch, this bundle includes the following services:

Everything you need to start your nonprofit with expert guidance!

What’s Included:

✅ Federal EIN: We’ll guide you through the process of obtaining your Employer Identification Number (EIN).

✅ State Registration: Assistance with filing the necessary paperwork for your state registration.

✅ Articles of Incorporation: Custom Articles of Incorporation tailored to your organization’s unique needs.

✅ IRS 501(c)(3) Status: Full support to help you obtain your 501(c)(3) tax-exempt status from the IRS.

✅ SAM.gov Registration: Setup assistance for your organization's registration on the System for Award Management (SAM) platform.

✅ Grants.gov Registration: Expert guidance to register on Grants.gov, giving you access to potential grant opportunities.

✅ Dunn & Bradstreet Registration Number: Step-by-step help to secure your D-U-N-S Number, boosting your organization’s credibility.📌 Perfect for: Organizations that want professionals to handle the setup process, ensuring everything is done right from start to finish!

Payment Arrangements:

We understand the financial considerations organizations face and offer a 3-payment installment plan to make our services more accessible.

- Payment Terms: Payments are due on the 15th of each month.

- Project Completion: The project will not be completed or delivered until the final payment is made in full.

- Refund Policy: Please note that all payments are non-refundable.

- DIY Bundles: Payment plans are not available for DIY bundles; full payment is required upfront.

At Intellectual Designs, our goal is to provide expert guidance and comprehensive support so your nonprofit can thrive. Let us handle the complexities of the 501(c)(3) process while you focus on creating a lasting impact in your community.

To get started or learn more about our service bundles and payment arrangements, please contact us today. We look forward to helping you achieve your nonprofit goals!

Take the Next Steps to Begin Your 501(c)(3) Application Process!

We are excited to assist you in obtaining your 501(c)(3) tax-exempt status and supporting your mission. To ensure the process runs smoothly, please complete the following steps:

1️⃣ Click the Link Below

Access our Google form by clicking here.2️⃣ Complete the Form

Fill out the required information to provide us with the details we need to proceed with your application.3️⃣ Notify Us

Once you’ve submitted the form, send a text message to 334-232-9281 to confirm. This will allow us to promptly review your information and begin the next steps.📌 Your Prompt Action is Key!

The sooner we receive your completed form, the faster we can start working on your 501(c)(3) application.At Intellectual Designs, we are dedicated to handling your application with care and professionalism. If you have any questions or need additional support, don’t hesitate to reach out to us.

📩 Start Your Journey Now!

Click the link, complete the form, and text us today! Let’s move forward together in achieving your nonprofit goals.Thank you for choosing Intellectual Designs!

Let’s Make Your Nonprofit Dream a Reality!

Complete the steps above to begin the journey toward 501(c)(3) tax-exempt status and propel your nonprofit into success.

Get started today!

About Us

Discover Lashawnda Shiree Love's diverse talents as an entrepreneur, author, singer, and community service provider. Get inspired and empowered to achieve your goals with her products and services, available on her official website.

Stay Connected

Follow me on Facebook

"Lashawnda Shiree Love"

Contact Us

334-232-9281

lashawndashiree@

Copyright 2019